25+ mortgage origination fee

Loan origination fees are. Ad 5 Best Home Loan Lenders Compared Reviewed.

10 Mortgage Form Templates In Pdf Doc

Web Loan Origination Fees.

. Compare Apply Get The Lowest Rates. It will likely be tacked onto your payment which youll be expected. Pre-approval in just three minutes.

This fee is paid upfront and is usually a percentage of the loan amount. Apply Now To Enjoy Great Service. Lets say you take out a 400000.

A fixed rate will not change for the life of the loan. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Here are some of the things you should know about this charge.

Compare Mortgage Lenders And Find Out Which One Suits You Best. For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm.

For example on a 200000 loan an origination fee of 1 would be 2000. Comparisons Trusted by 55000000. Ad Try the CRM with the most tools.

Typically this range is anywhere between 05 and 1. They usually fall between 05 and 1 of a borrowers mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Fees to reimburse the. Web These are mortgage origination fees charged by the MLO for processing and underwriting the loan. An application processing fee An underwriting fee A.

Web Mortgage origination fees are generally 05 to 1 of the value of the loan. Compare Mortgage Lenders And Find Out Which One Suits You Best. Comparisons Trusted by 55000000.

One important thing to note is that in the same area where. Web If you borrow a 10000 student loan with a 1057 origination fee for instance. Origination fees consist of all of the following.

Web Direct Unsubsidized Loans. Some of the charges included in a mortgage origination fee include. Compare Best Mortgage Lenders 2023.

On average expect to pay 05-10 of your loans principal to cover your mortgage origination charge. Web While they vary by lender origination fees are typically anywhere between 1 to 2 of the total loan amount. Some factors that can determine the size of your fee include.

In many cases origination costs amount to about 05 to 1. Web Loan origination fees are usually a percentage of the total loan amount. All interest rates shown in the chart above are fixed rates.

Let our all in one system do the heavy lifting so you can focus on closing more loans. Application submission in as little as 15 minutes. Ad 5 Best Home Loan Lenders Compared Reviewed.

If the cost of the fee is taken from the proceeds of a loan you still have 13500 in proceeds. Chat e-sign surveys websites much more. Apply Online Get Pre-Approved Today.

The fee is compensation for executing the loan. Web A mortgage origination fee is an upfront fee charged by a lender to process a new loan application. They typically cost 05 1 of the total loan amount.

Fees that are being charged to the borrower as prepaid interest or to reduce the loans nominal interest rate such as interest buy-downs explicit yield adjustments b. Compare Apply Get The Lowest Rates. Ad Compare Home Financing Options Get Quotes.

Compare Loans Calculate Payments - All Online. Origination fees can be. Web The fee is charged based on a percentage of the loan amount.

Web How much are loan origination fees. The Search For The Best Mortgage Lender Ends Today. Web If you charged 1 percent on a 15000 loan that amounts to a 1500 origination fee.

Web A mortgage origination fee is a charge from your lender that covers processing costs. So for example if youre borrowing 30000 a 2 origination fee will add 600 to. For example a borrower with a loan amount of 100000 can expect to pay around 500 to.

Web A mortgage origination fee is a charge from your mortgage lender that compensates it for services involved in giving you a loan. Web These fees typically include such items as document preparation underwriting appraisal costs credit reports tax research and more. The Search For The Best Mortgage Lender Ends Today.

Web An origination fee is a fee that a borrower pays to a lender when applying for a loan. Ad Highest Satisfaction for Mortgage Origination. This late fee may be a flat fee such as 25 or a percentage of your payment amount such as 6.

Origination fees usually reflect a fairly small percentage of the loan amount. Ad Highest Satisfaction for Mortgage Origination. Apply Now To Enjoy Great Service.

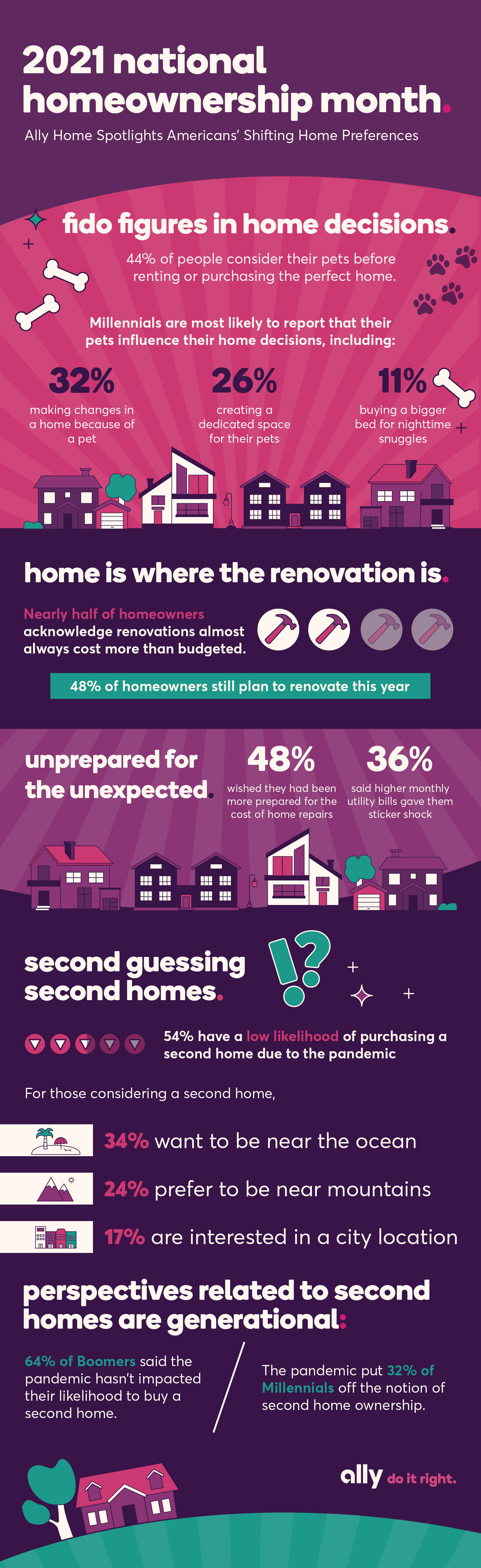

The lender uses this fee to cover the costs of processing the loan application. Parents and Graduate or Professional Students. Ally HomeReady loan allows for a slightly smaller downpayment at 3.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

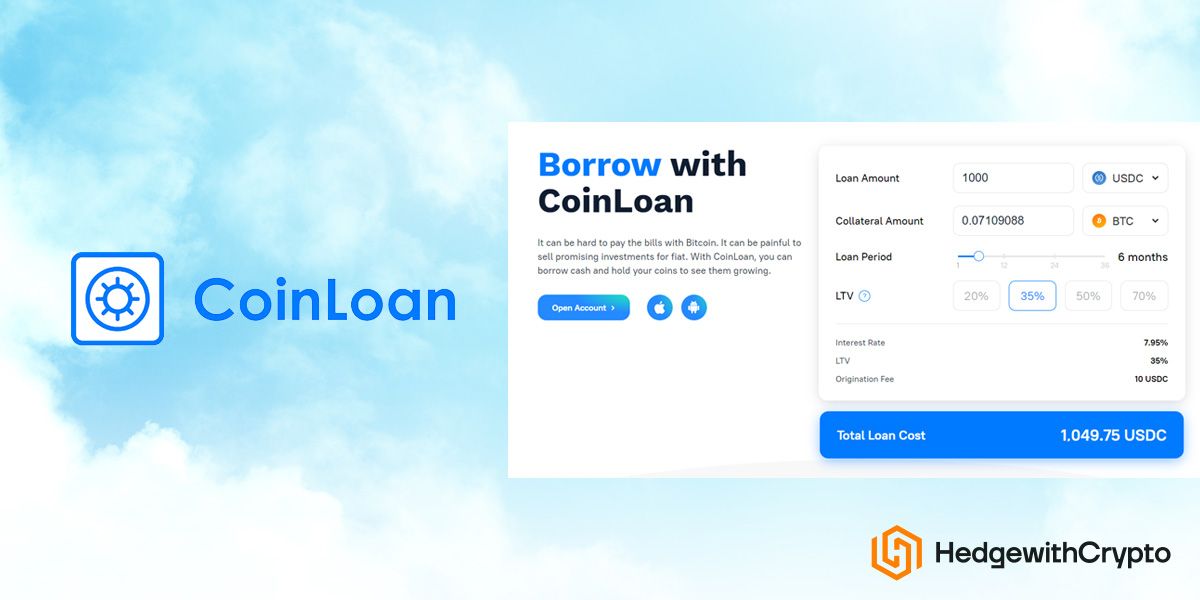

Coinloan Review 2023 Features Crypto Loans Fees

Dividend Stock Analysis Intercontinental Exchange

Loan Origination Processes And Challenges Part 2 Mortgage Loans

![]()

Origination Fee Definition Average Cost And Ways To Save

Ally Survey Pet Perks Play Pivotal Role In Home Purchase Decisions Jun 1 2021

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Quicken Loans Review

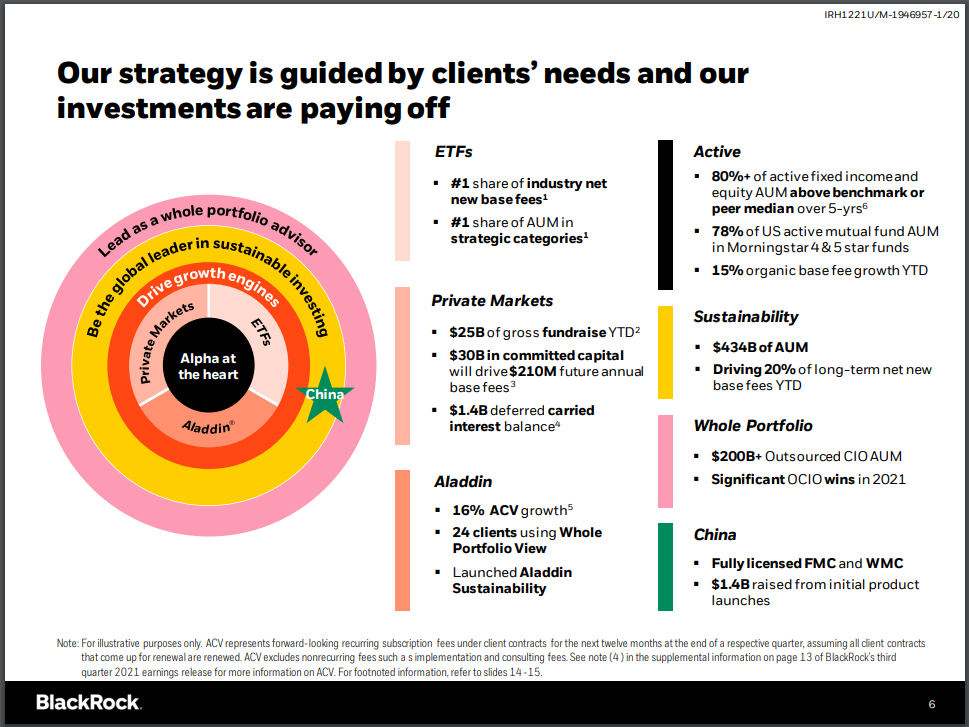

10 Wide Moat Stocks To Buy Now

Lowest Rates In The Nation Lowest Nj Mortgage Rates New Jersey Refinance Refinance Mortgage Nj

What Is A Loan Origination Fee Mortgages And Advice U S News

Fee Collection Msr Acquisition Tools Deep Dive Into Recent Rate Moves Capital Markets

A Guide To Mortgage Origination Fees Fortune Recommends

Executive Summary Platform Components Grid Financial Services Inc Is A Business Process Outsource Firm Located In Raleigh Nc Grid Financial Has A Ppt Download

8 Best Mortgage Lenders With Low Origination Fees Of 2023

/images/2021/07/19/what-is-origination-fee.jpg)

What Is An Origination Fee And What Clever Borrowers Know About It Financebuzz

Origination Fee For Mortgage Bankrate

Accounting Ops Mlo Jobs Amc Lead Warehouse Products Financial Transparency Employment Figures Sink Rates